Perfectly competetive market

Perfect competition is a common market structure with very desirable properties, so it is useful to compare other market structures to competition.

Economists say that a market is perfectly competitive if each firm in the market is a price taker that cannot significantly affect the market price for its output or the prices at which it buys inputs. Why would a competitive firm be a price taker? Because it has no choice. The firm has to be a price taker if it faces a demand curve that is horizontal at the market price.

Perfectly competitive markets have five characteristics that force firms to be price takers:

- The market consists of many small buyers and sellers.

- All firms produce identical products.

- All market participants have full information about price and product characteristics.

- Transaction costs are negligible.

- Firms can easily enter and exit the market.

Residula Demand

In competetive markets firms face perfectly elastic demand. However, that doesn't mean the demand for the good is perfectly elastic. It just means demand facing any firm is perfectly elastic.

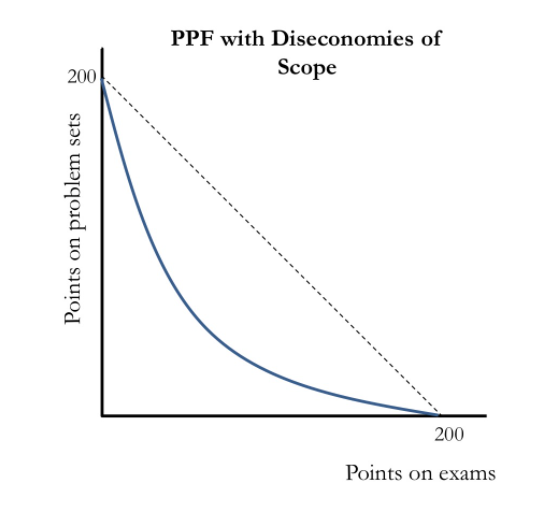

An individual firm faces a residual demand curve: the market demand that is not met by other sellers at any given price. The firm's residual demand function, \(D^{r}(p)\), shows the quantity demanded from the firm at price p. A firm sells only to people who have not already purchased the good from another seller. We can determine the quantity that a particular firm can sell at each possible price using the market demand curve and the supply curve for all other firms in the market. The quantity the market demands is a function of the price: \(Q = D(p)\).

The supply curve of the other firms is \(S^{0}(p)\). The residual demand function equals the market demand function, \(D(p)\), minus the supply function of all other firms: \(D^{r}(p) = D(p) - S^{0}(p)\). At prices so high that the amount supplied by other firms, \(S^{0}(p)\), is greater than the quantity demanded by the market, \(D(p)\), the residual quantity demanded, \(D^{r}(p)\), is zero.

Let's compute elasticities from the formula (1), by differentiating both sides by price. We get \(\frac{dD^{r}}{dp} = \frac{dD}{dp} - \frac{dS^{0}}{dp}\).

In a market with n identical firms, the elasticity of demand, ei, facing Firm i is

\(\varepsilon_i = n\varepsilon - (n - 1)\eta_0\),

where \(\varepsilon\) is the market elasticity of demand (a negative number), \(\eta_0\) is the elasticity of supply of the other firms (typically a positive number), and \(n - 1\) is the number of other firms. \(q = \frac{Q}{n}\) is the demand of one firm, rest of supply is given by \(S^{0} = (n-1)q\)

Example

The Canadian metal chair manufacturing market has n = 78 firms. The estimated elasticity of supply is \(\eta\) = 3.1, and the estimated elasticity of demand is \(\epsilon\) = -1.1. Assuming that the firms are identical, calculate the elasticity of demand facing a single firm. Is its residual demand curve highly elastic?

From the example we can see, that though market has not high elasticity of demand, however the elasticity of demand for individual firm is extremely elastic.

Short run profit maximization for a firm

We assume that in the short-run no entry and exit.

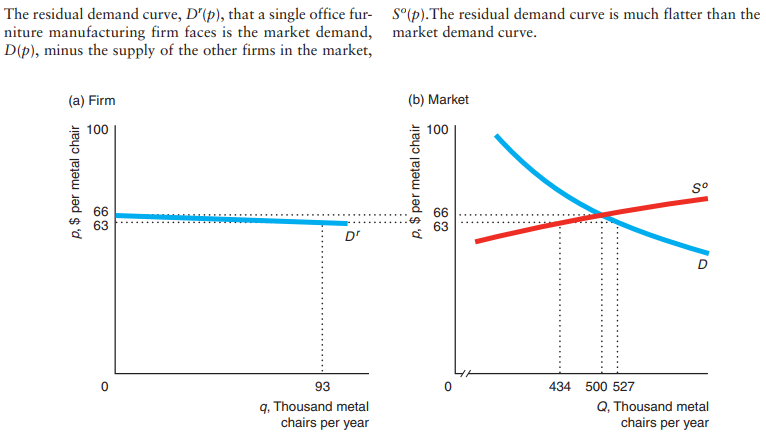

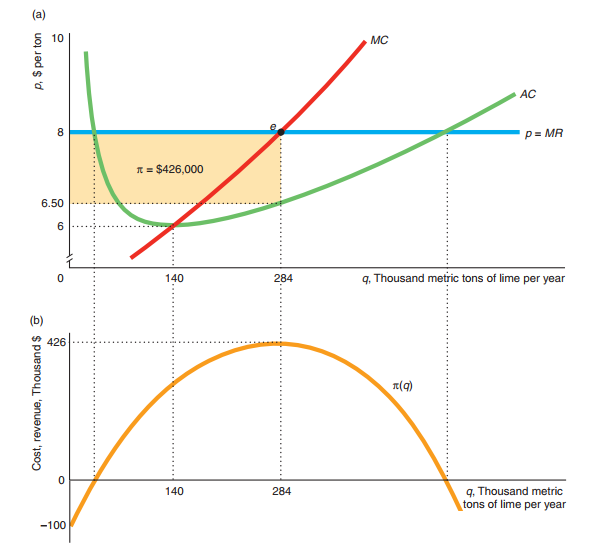

Profit is Revenue minus Cost, or in mathematical terms,

\(\Pi (p) = R(q) - C(q)\).

The profit maximizing firm is always going to set marginal revenue equal to marginal cost. In a competitive market the marginal revenue company earn on the next unit that it sells is a market price.

Basically, in the competitive market the profit maximizing condition is simply the marginal cost should be equal to the market price.

So, knowing the price, firm will produce untill marginal cost will be equal to the price.

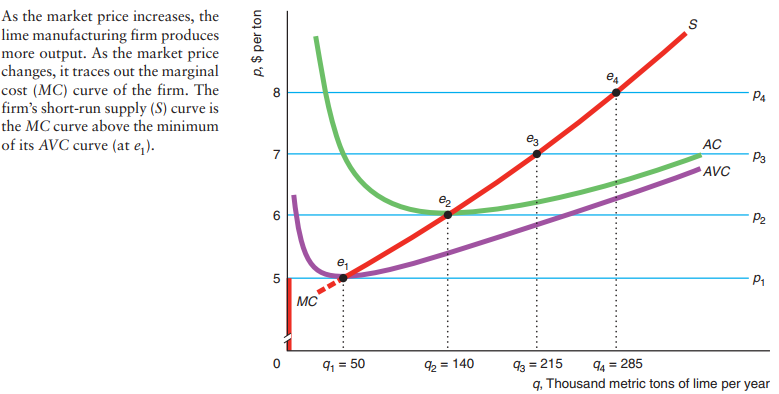

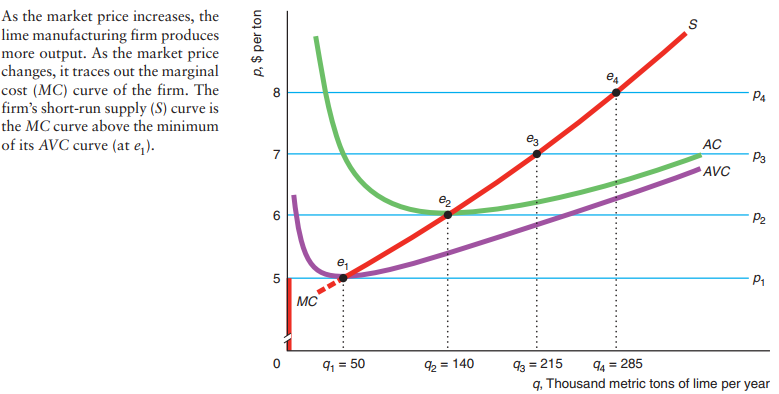

Shutdown rule: \(p < AVC\)

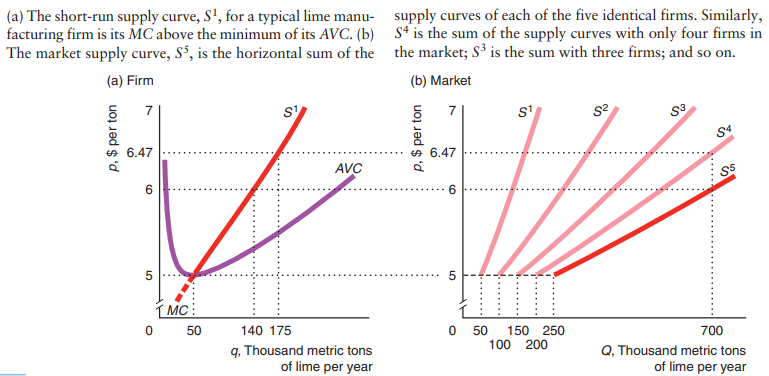

Deriving The Short Run Supply Curve

At each price, the firm is choosing to set the marginal cost equal to that price.

The supply curve is the firm's marginal cost curve.

Profit maximization drives the firm to set the marginal cost equal to price. So the firm's marginal cost curve is the firm's supply curve.

Market supply is going to be the horizontal sum, the horizontal sum of the firms' supply.

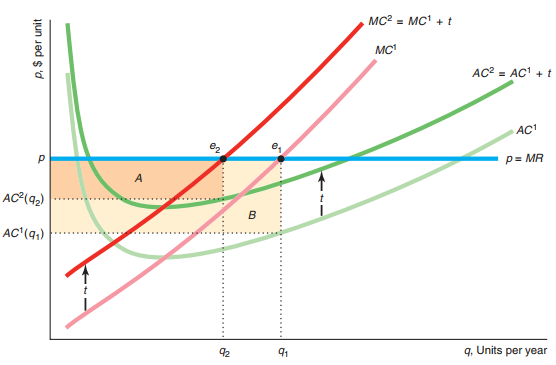

Long-Run Perfect Competition

Distinction between short-run perfect competition:

-

- Short-run shutdown rule dictates us that, when \(p < AVC\), we stop producing.

-

- Long-run shutdown rule dictates us that, when \(p <AC\) , we stop producing.

- Entry and Exit

In a competitive market, firms will enter if there's profits being made and exit if there's profits money being lost.

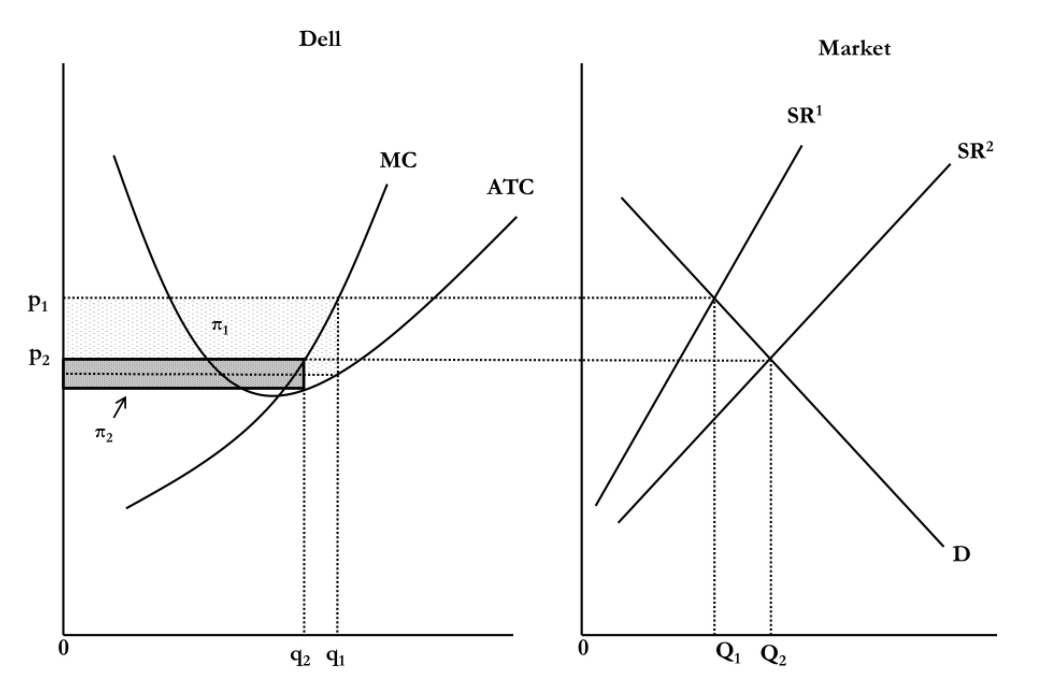

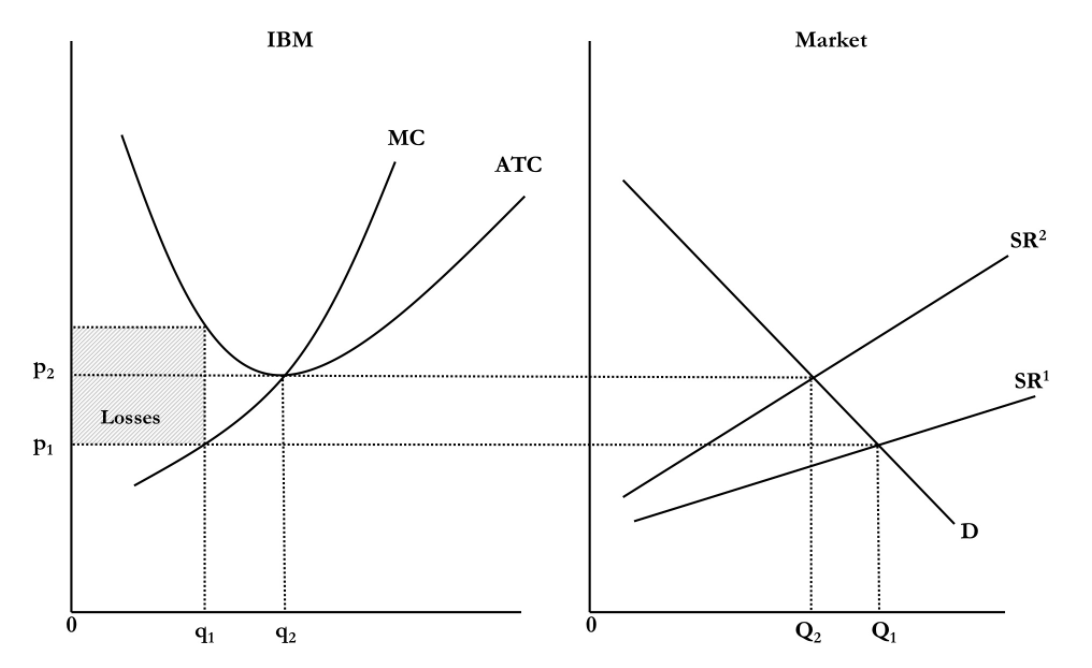

In the long run, in a perfectly competitive market, firms will enter and exit until profits are zero. Entry and exit for firms in a competitive market drives profits to zero.

Long-Run Market Supply When Input Prices Vary with Output.

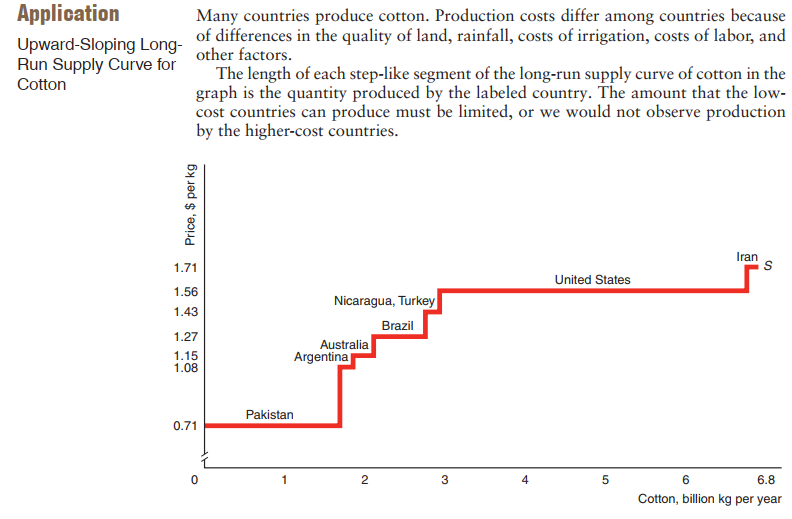

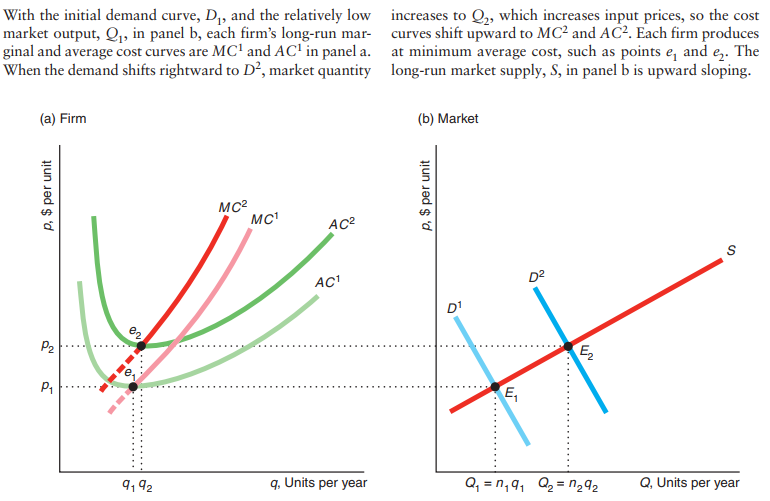

A reason why long-run market supply curves may slope upward is non-constant input prices. In markets where factor prices rise when output increases, the long-run supply curve slopes upward even if firms have identical costs and can freely enter and exit.

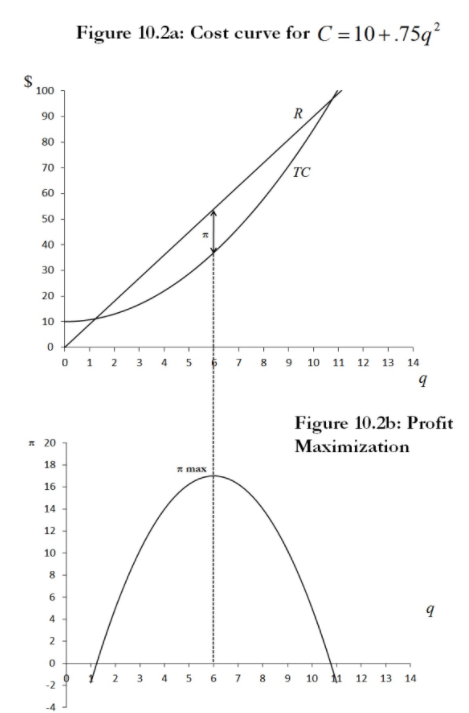

Economies of Scope

Scope is the range of products that firm produce. An economy of scope is when, if firm produce two goods, how does it compare to the efficiency of just producing one good.

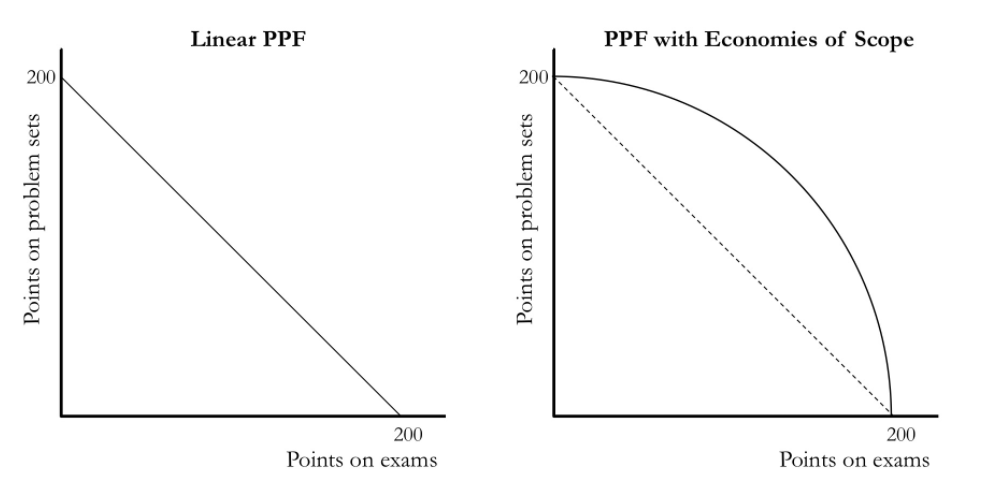

Production possibilities frontier(PPF) shows the maximum combination of outputs that can be produced for any combination of inputs.