Oligopoly

People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or some contrivance to raise prices — Adam Smith, 1776.

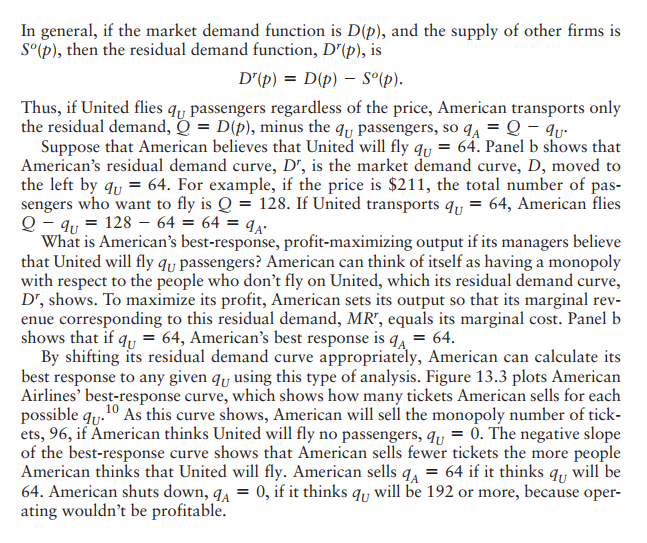

Oligopolistic firms may act independently or may coordinate their actions. A group of firms that explicitly agree (collude) to coordinate their activities is called a cartel. These firms may agree on how much each firm will sell or on a common price. By cooperating and behaving like a monopoly, the members of a cartel collectively earn the monopoly profit—the maximum possible profit. In most developed countries, cartels are generally illegal.

If oligopolistic firms do not collude, they earn lower profits. However, because oligopolies consist of relatively few firms, oligopolistic firms that act independently may earn positive economic profits in the long run, unlike competitive firms.

Cartels

In the late nineteenth century, cartels (or, as they were called then, trusts) were legal and common in the United States. Oil, railroad, sugar, and tobacco trusts raised prices substantially above competitive levels.

In response to the trusts' high prices, the U.S. Congress passed the Sherman Antitrust Act in 1890 and the Federal Trade Commission Act of 1914, which prohibit firms from explicitly agreeing to take actions that reduce competition. In particular, these laws prohibit cartels from collectively setting prices. In legal jargon, such pricefixing is a per se violation: It is strictly against the law and firms have no possible mitigating justifications. By imposing penalties on firms caught colluding, government agencies seek to discourage cartels from forming. The Antitrust Division of the Department of Justice (DOJ) and the Federal Trade Commission (FTC) divide the responsibility for U.S. antitrust policy. The U.S. Department of Justice, quoting the Supreme Court that collusion was the "supreme evil of antitrust," stated that prosecuting cartels was its "top enforcement priority." The FTC's objective is "to prevent unfair methods of competition in commerce" and "to administer . . . other consumer protection laws." Both U.S. agencies can use criminal and civil law to attack cartels, price-fixing, and other anticompetitive actions.

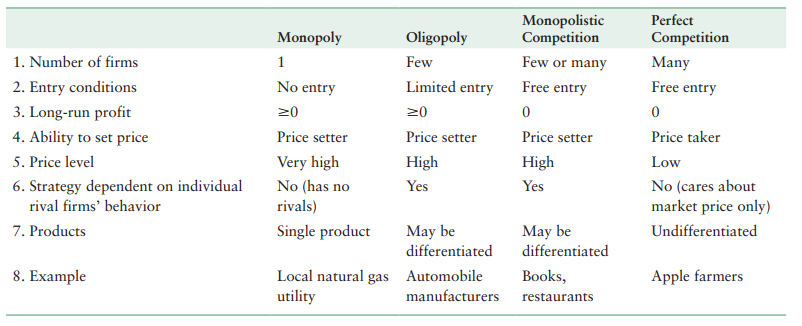

- Market Structures. The number of firms, price, profits, and other properties of markets vary, depending on whether the market is monopolistic, oligopolistic, monopolistically competitive, or competitive.

- Cartels. If firms successfully coordinate their actions, they can collectively behave like a monopoly.

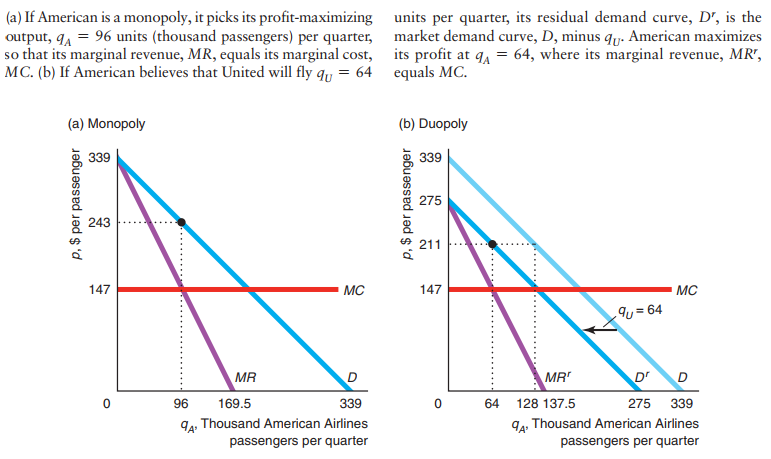

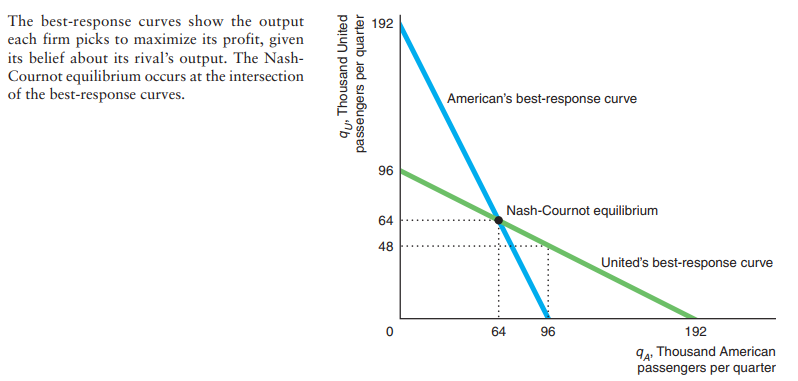

- Cournot Oligopoly. In a Cournot oligopoly, firms choose their output levels without colluding and the market output, price, and firms' profits lie between the competitive and monopoly levels.

- Stackelberg Oligopoly. In a Stackelberg oligopoly, in which a leader firm chooses its output level before its identical-cost rivals, market output is greater than if all firms choose their output simultaneously, and the leader makes a higher profit than the other firms.

- Bertrand Oligopoly. In a Bertrand oligopoly, in which firms choose prices, the equilibrium differs from the quantity-setting equilibrium and depends on the degree of product differentiation.

- Monopolistic Competition. When firms can freely enter the market but, in equilibrium, face downward-sloping demand curves, firms charge prices above marginal cost but make no profit

Cournot model of non-cooperative oligopoly

Cournot equilibrium (Nash-Cournot equilibrium) a set of quantities chosen by firms such that, holding the quantities of all other firms constant, no firm can obtain a higher profit by choosing a different quantity.

The firm's strategy is the best strategy given what the other firm's going to do.

Main steps:

- Residual demand

- MR function of the other firm's quantity

- MR = MC

- Repeat the same steps for all firms

- Solve system of n equations

Game theory

A game is an interaction between players (such as individuals or firms) in which players use strategies.

A strategy is a battle plan that specifies the actions that a player will make.

An action is a move that a player makes at a specified stage of a game, such as how much output a firm produces in the current period.

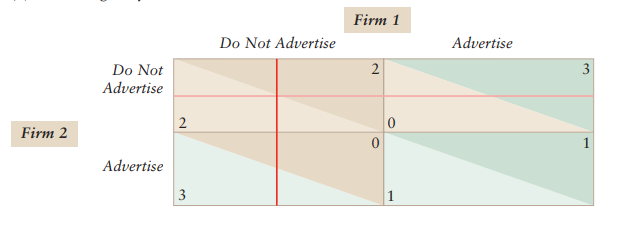

Nash equilibrium a set of strategies such that, when all other players use these strategies, no player can obtain a higher payoff by choosing a different strategy.