Capital

Capital represents the diversion of current consumption towards production and therefore future consumption.

Example is agriculture.

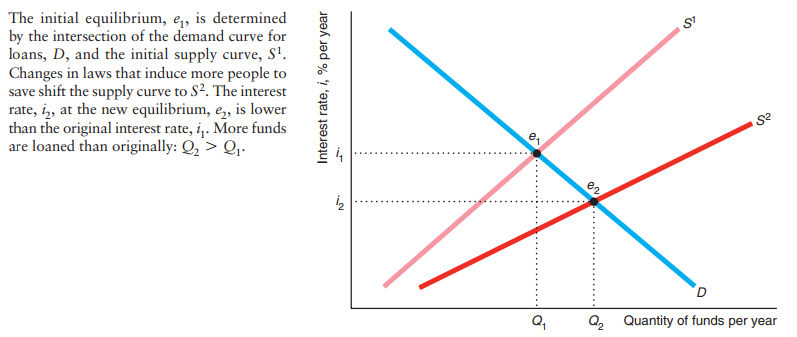

Capital markets in the US work as individuals set aside money that they don't want to consume today, but might want to consume tomorrow. They loan that money to firms. Firms turn that money into machines, and buildings

Firms get the money from the capital market.

Individuals decide to save money, so they invest their money into capital market. Firms take that money from capital market.

The interest rate is what a firm has to pay to use your money.If the interest rate is 10%, that means that if the firmwants to use $1 from you for one period, it has to pay you back $1.10 next period.

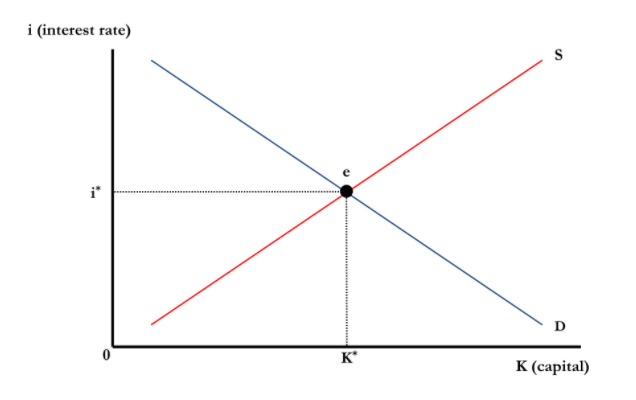

Supply curve

For every dollar of consumptionI defer today, I turn it into one plus I dollars tomorrow.

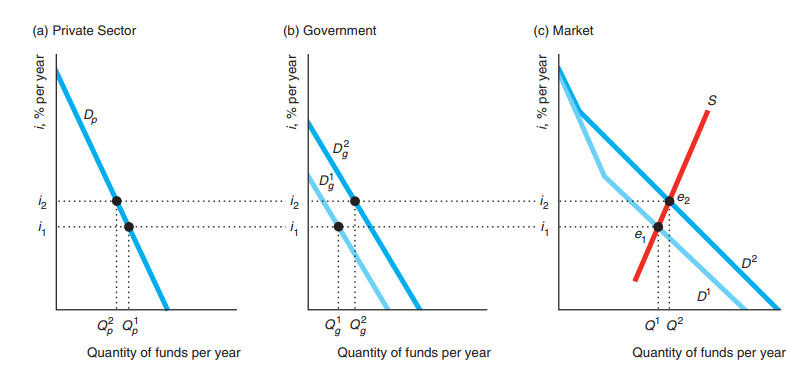

Example: Suppose the government needs to borrow money to pay for fighting a war in a foreign land. Show that increased borrowing by the government—an increase in the government's demand for money at any given interest rate—raises the equilibrium interest rate, which discourages or crowds out private investment.

Solution:

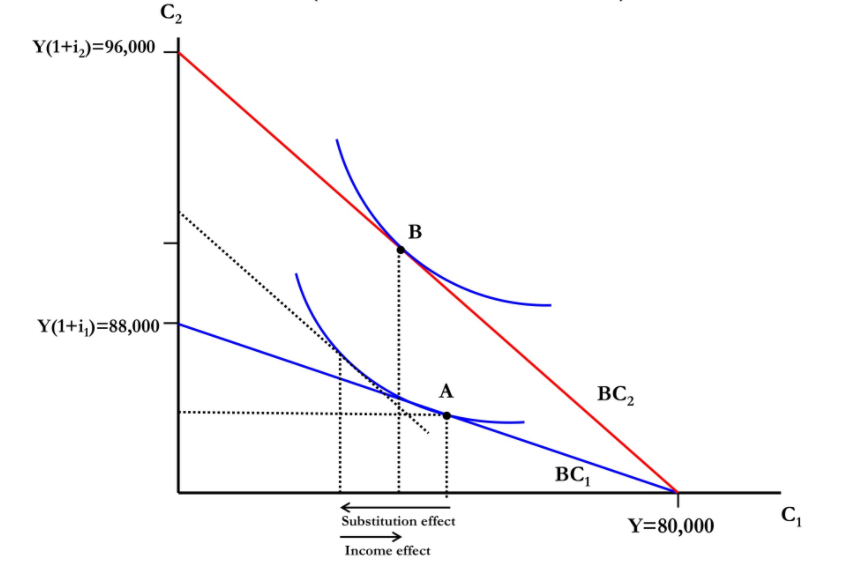

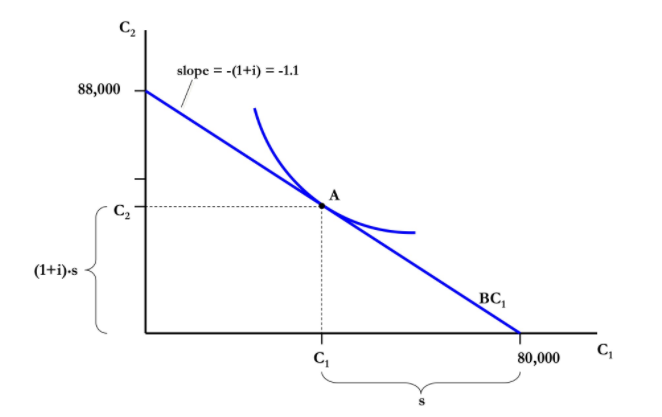

Intertemporal Consumption

Max \(U(C_1, C_2)\) Subject \(C_1 + \frac{C_2}{1+i} = Y\)

Interest shocks